Background

DEX is planned to be implemented as Iroha 2.0 module.

Action items

Problem

Decentralized exchange provides an ability to transfer assets between accounts in exchange for other assets. :

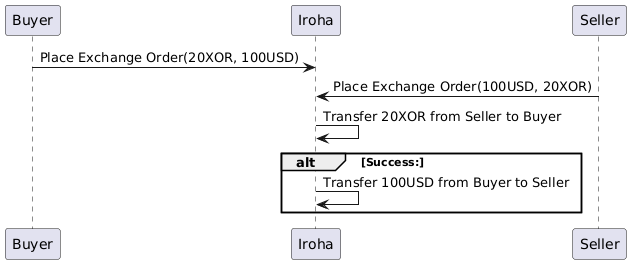

Peer to Peer Scenario

Plant UML

@startuml

Buyer -> Iroha: Place Exchange Order(20XOR, 100USD)

Seller -> Iroha: Place Exchange Order(100USD, 20XOR)

Iroha -> Iroha: Transfer 20XOR from Seller to Buyer

alt Success:

Iroha -> Iroha: Transfer 100USD from Buyer to Seller

end

@enduml

So Iroha should secure peer to peer exchanges across the ledger from malicious actions. In this case Iroha does a good job, the only thing it should check is an ability to transfer assets from and to accounts.

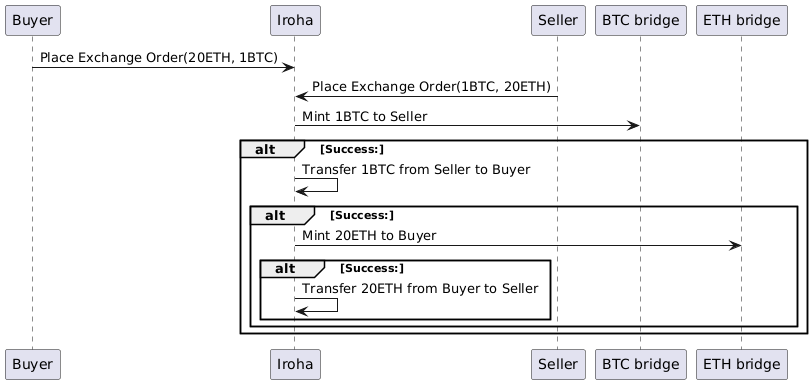

But there are more corner cases when we deal with exchanges via bridge:

Peer to Peer across Bridge Scenario

- Cross blockchain rates should be taken into consideration

- Iroha should prevent double spent of assets

- Additionally to transferring assets, Iroha should mint and de-mint them

Simple scenario:

Plant UML

@startuml

Buyer -> Iroha: Place Exchange Order(20ETH, 1BTC)

Seller -> Iroha: Place Exchange Order(1BTC, 20ETH)

Iroha -> "BTC bridge": Mint 1BTC to Seller

alt Success:

Iroha -> Iroha: Transfer 1BTC from Seller to Buyer

alt Success:

Iroha -> "ETH bridge": Mint 20ETH to Buyer

alt Success:

Iroha -> Iroha: Transfer 20ETH from Buyer to Seller

end

end

end

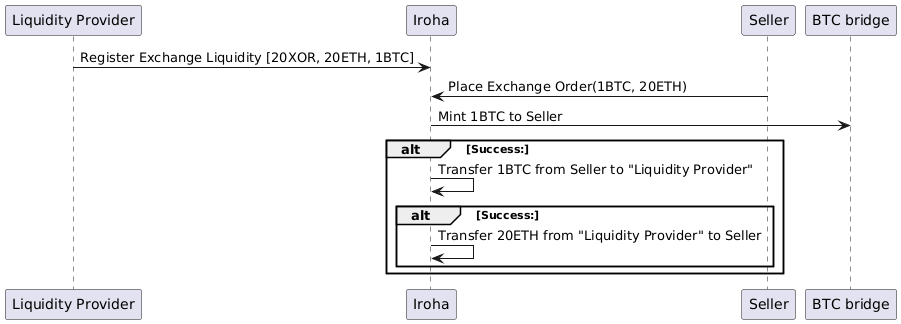

@endumlLiquidity Pools is another dimension in this set of scenarios for Decentralized Exchanges. Basically it can be used in pair with or without bridges, so let's take a more clean example without them. But let's not stick to an Exchange Pair and work with multi-currency liquidity:

Plant UML

@startuml

"Liquidity Provider" -> Iroha: Register Exchange Liquidity [20XOR, 20ETH, 1BTC]

Seller -> Iroha: Place Exchange Order(1BTC, 20ETH)

Iroha -> "BTC bridge": Mint 1BTC to Seller

alt Success:

Iroha -> Iroha: Transfer 1BTC from Seller to "Liquidity Provider"

alt Success:

Iroha -> Iroha: Transfer 20ETH from "Liquidity Provider" to Seller

end

end

@endumlFrom the high level perspective this scenario looks very similar with two previous because all of them are based on top of two Iroha functions:

- Assets Transfer

- Iroha Triggers

Resulting Behavior

Let's write all three scenarios as one feature description according to BDD with more details:

Click here to expand...

Feature: Decentralized Exchange

Scenario: Buyer exchanges 20xor for 100usd

Given Iroha Peer is up

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name buyer and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name xor and domain exchange

And Peer has Asset Definition with name usd and domain exchange

And buyer Account in domain exchange has 100 amount of Asset with definition usd in domain exchange

And seller Account in domain exchange has 20 amount of Asset with definition xor in domain exchange

When buyer Account places Exchange Order 20xor for 100usd

And seller Account places Exchange Order 100usd for 20 xor

Then Iroha transfer 20 amount of Asset with definition xor in domain exchange from seller account in domain exchange to buyer account in domain exchange

And Iroha transfer 100 amount of Asset with definition usd in domain exchange from account buyer in domain exchange to seller account in domain exchange

Scenario: Buyer exchanges 1btc for 20eth across bridges

Given Iroha Peer is up

And Iroha Bridge module enabled

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name buyer and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name btc and domain exchange

And Peer has Asset Definition with name eth and domain exchange

And Peer has Bridge with name btc and owner btc_owner

And Peer has Bridge with name eth and owner eth_owner

And eth Brdige has buyer Account in domain exchange registered

And btc Brdige has seller Account in domain exchange registered

When buyer Account places Exchange Order 20xor for 100usd

And seller Account places Exchange Order 100usd for 20 xor

Then Iroha mint 1 amount of Asset with definition btc in domain exchange to seller Account in domain exchange using btc Bridge

And Iroha mint 20 amount of Asset with definition eth in domain exchange to buyer Account in domain exchange using eth Bridge

And Iroha transfer 1 amount of Asset with definition btc in domain exchange from seller account in domain exchange to buyer account in domain exchange

And Iroha transfer 20 amount of Asset with definition eth in domain exchange from buyer account in domain exchange to seller account in domain exchange

Scenario: Buyer exchanges 20xor for 100usd

Given Iroha Peer is up

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name liquidity_provider and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name xor and domain exchange

And Peer has Asset Definition with name btc and domain exchange

And Peer has Asset Definition with name eth and domain exchange

And liquidity_provider Account in domain exchange has 1 amount of Asset with definition btc in domain exchange

And liquidity_provider Account in domain exchange has 20 amount of Asset with definition eth in domain exchange

And liquidity_provider Account in domain exchange has 20 amount of Asset with definition xor in domain exchange

And seller Account in domain exchange has 20 amount of Asset with definition eth in domain exchange

When liquidity_provider Account registers Exchange Liquidity 20xor and 20eth and 1btc

And seller Account places Exchange Order 20eth for 1btc

Then Iroha transfer 1 amount of Asset with definition btc in domain exchange from seller account in domain exchange to liquidity_provider account in domain exchange

And Iroha transfer 20 amount of Asset with definition eth in domain exchange from liquidity_provider account in domain exchange to seller account in domain exchangeSolution

DEX realated entities could be represented via Iroha model (Domains, Assets and their definitions), while complex sequences of actions could be implemented via Iroha Special Instructions + Triggers.

Decisions

- Introduce a new module "DEX" with a dependency on "Bridge" module with additional set of Iroha Special Instructions and Queries and new Abstractions like Order (Combination of a Trigger and Asset with a predefined Asset Definition)

- Implement Use cases

- Implement Iroha Special Instructions DSL

Alternatives

- Provide out-of-the-box entities and instructions for DEX - breaks modular approach giving to much information about private API to DEX module and making it mandatory for all peers once it introduced to the ledger

- Make World State View public API - removes possibility to improve internal processes without breaking back compatibility

Concerns

- Users without deep knowledge of Iroha model and instructions may fail to implement this

Assumptions

- Iroha modules need to be optional Iroha features

- Iroha Special Instructions DSL is separated from execution implementations

Risks

- Given functionality will not cover all corner cases `[3;8]`

- Performance may be insufficient for DEX `[2;9]`